iRobot: The reality of the robot invasion is true and today we trade the king of domestic robots - the creation of roomba

It is an invasion. With the rise of AI and and bots that can do things around the house like the roomba cleaner – this is the company on the forefront of the domestic robot revolution. Today we trade them and are expecting a nice jump move.

The question for investors is: Are vacuum-cleaning robots worth investing in? It may not seem like the kind of product investors should be excited about, but investing in robotic vacuums may be a smarter move than you think.

The technology that separates iRobot in RVCs from competitors like Dyson, Samsung, and Hoover is its sensing and mapping technology. Roombas simply perform better than their competitors, and that allows iRobot to spread its research and development (R&D) spending across more devices, which ultimately leads to higher profits. And the fact that it has greater scale in RVCs lowers costs as well. The leverage dynamic can be seen below, with gross margin and net income both on the rise over the last five years. It’s tough to gauge whether or not competitors are seeing higher margins because they’re either private (Dyson) or vacuums are a small portion of sales (Samsung), but iRobot’s trends indicate a strong position in the market.

But what about earnings?

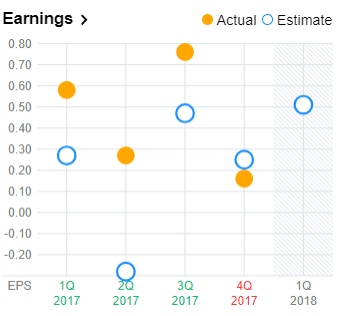

The company pulled off an impressive average positive earnings surprise of 113.01% over the preceding four quarters. Notably, iRobot’s adjusted earnings per share in fourth-quarter 2017 came in at 54 cents per share, beating the Zacks Consensus Estimate of 26 cents.

Let’s see how things are shaping up prior to this announcement.

See what the IHS Markit Score report has to say about ADTRAN Inc.

ADTRAN Inc

NASDAQ/NGS:ADTN

Score: Positive (94)

27 days at current score.

Upgraded from Neutral on March 15th 2018

Summary

- This company ranked positively compared to the Technology sector despite only 2 positive IHS Markit Categories

- ETFs holding this stock are seeing positive inflows

- Bearish sentiment is low

- Economic output for the sector is expanding but at a slower rate

Bearish sentiment

Short interest | Positive

Short interest is extremely low for ADTN with fewer than 1% of shares on loan. This could indicate that investors who seek to profit from falling equity prices are not currently targeting ADTN.

Money flow

ETF/Index ownership | Positive

iRobot, Inc. (IRBT) will be posting its FQ1-18 quarterly earnings results today at close. [IRBT] is expected to post earnings of $.50 per share on revenue of $215.61 Million. In the last quarter, the company reported $.16 earnings per share MISSING the analysts’ consensus estimate of $.25

Last 3 Quarters: “Jump Zone” Move: -32.3%, -13.91%, 24.45%

Consensus Estimates: ($NA whisper) ($.57 estimize) ($.50 wall street)

Huge jump zones on this one. Today we expect double digit profit in your pocket.

Someday it will be fun to tell your robot maid to clean up the dishes. For today, lets clean up on this one in the trade room.

Robots begin.