HCSG: Today we trade the cleaning and snacks company in the medical sector... and we intend to clean house.

Today is Healthcare Services Group Inc, a mid-sized company company with a market capitalization of US$3.20B, that specializes in janitor and other services for hospitals and urgent care centers.

According to three top Motley Fool investors asked to each pick a stock that they believe Wall Street is overlooking today they picked HCSG as one of them. Let’s drill down and find out why, and then look at today’s “jumper” numbers.

This company provides housekeeping and nutritional services to healthcare facilities across the U.S. While its business is as boring as it comes, investors who have held onto this company for the long term have walloped the S&P 500

How has the company pulled this off? The answer is that Healthcare Services Group has a knack for consistently bringing new customers into the fold while simultaneously selling more services to existing ones. That’s a simple, but powerful, combination.

In recent years, the company’s growth has been driven by the company’s dining and nutrition services business. This division grew by 60% last quarter and helped the company post overall revenue growth of 26%.

We think they are good today for a 10% jump in price… but which way?

Might seem like a boring company – but someone has to do this work, and these guys figured out how to do it well, create a great company in the process and make their investors happy. Now to us all that matters is what happens today.

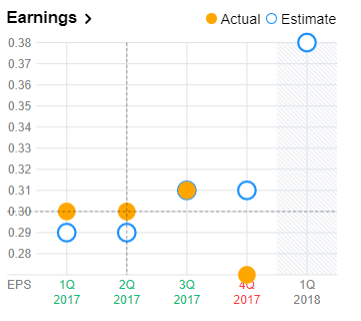

Healthcare Services Group, Inc. (HCSG) will be posting its FQ1-18 quarterly earnings results today at close. [HCSG] is expected to post earnings of $.39 per share on revenue of $504.52 Million. In the last quarter, the company reported $.27 earnings per share BELOW the analysts’ consensus estimate of $.32 The stock is currently trading at $43.13 per share.

Last 3 Quarters – “Jump Zone” Move: -11.71%, -4.69%, 12.22%

Consensus Estimates: ($ N/A whisper) ($.39 estimize) ($.39 wall street)

So get out those mops, and get in the trade room and lets ring out as much profit from today’s trade as possible.

by Team Stockjumpers

by Team Stockjumpers